Midwinter Financial Advice Software

Midwinter Financial Advice Software is a comprehensive financial planning solution built for humans – those who provide advice, and those who rely on advice to make smart financial decisions.

The powerful advice software provides sophisticated financial modelling, practice management and client engagement tools, to simplify how you provide advice.

Midwinter was built for every financial advice business – from small practices to large institutions. As a cloud-based financial advice solution it’s easy to implement into your practice and Midwinter looks after all of the software updates and management.

Take your practice into the digital age with an AdviceTech solution built for the future.

Everything You Need to Provide Great Advice

Midwinter Financial Advice Software provides end-to-end client management, research, modelling, advice generation, and compliance capabilities.

Our modular approach allows you to pick the modules you need for your practice now and scale these to meet the changing needs of your business.

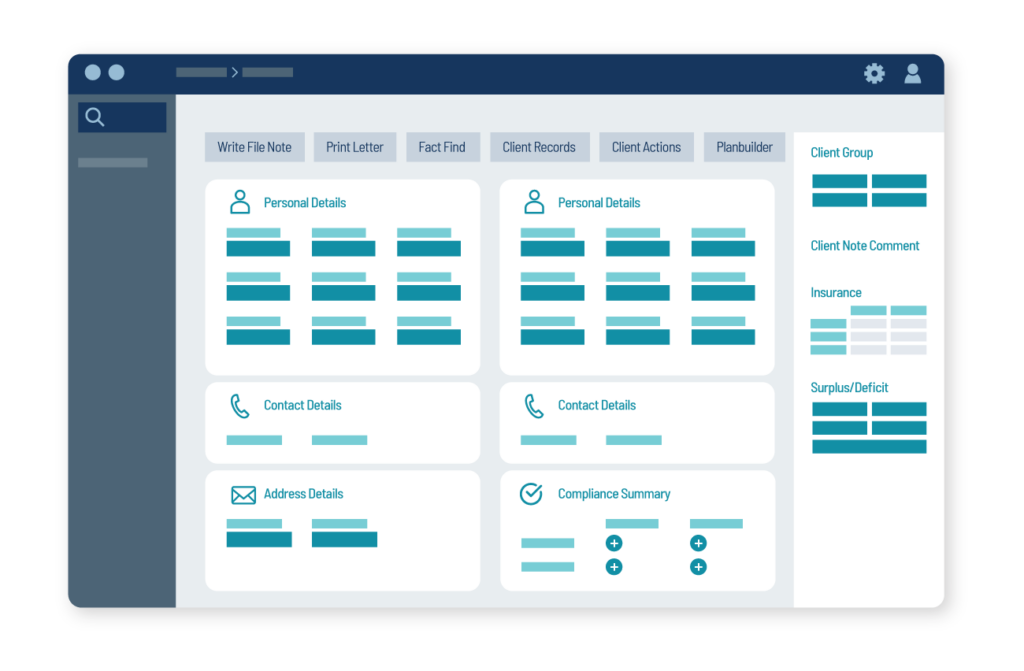

CRM MODULE

Manage client relationships and compliance

The comprehensive Midwinter CRM provides everything you need to track and manage client relationships, as well as advice specific reporting and compliance management such as FDS.

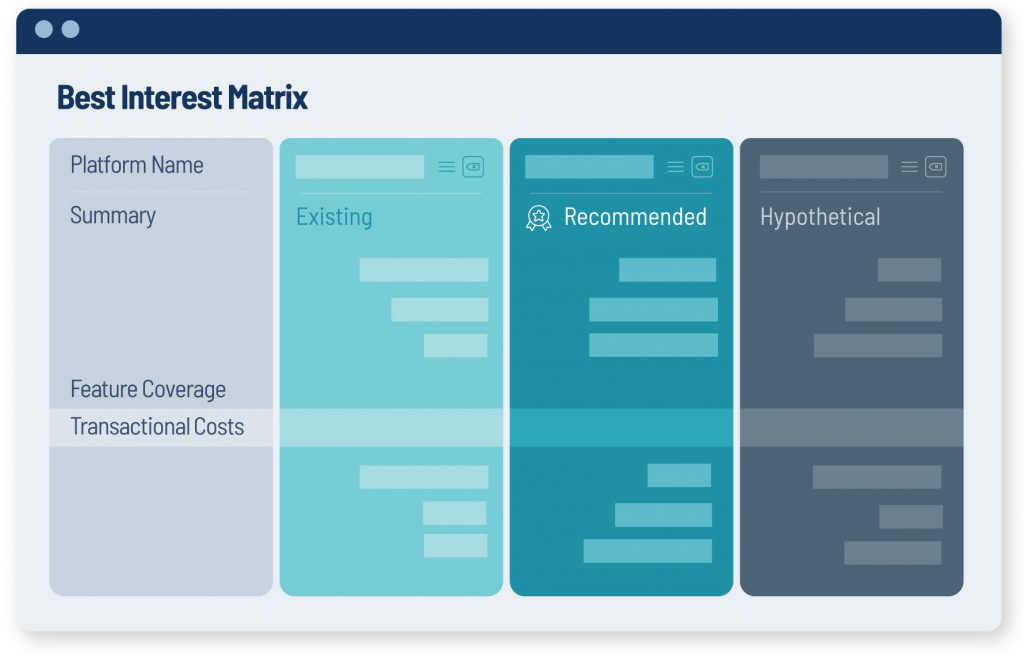

PRODUCT MODULE

Compare products and analyse client portfolios

Analyse client needs, compare products and determine their optimal portfolio while also meeting your best interests duty for your clients.

INSURANCE MODULE

Ensure clients have the right insurance for their needs

Analyse client needs, compare insurance and determine the best product choice while also meeting your best interests duty for your clients.

STRATEGY MODULE

Conduct comprehensive financial strategy reviews

Extensive modelling tools for transitions, contribution, retirement and advice strategy generation.

ADVICE DOCUMENTS

A simple and customisable advice document solution

Legal-reviewed advice document templates that are regularly updated in line with legislative changes and offer cost and customisation options to suit your business.

MULTIGOAL MODULE

Provide real-time multi-goal advice

Engage your clients by evaluating multi-goal scenarios in real time, and create a comprehensive goal map for your clients in a single meeting.

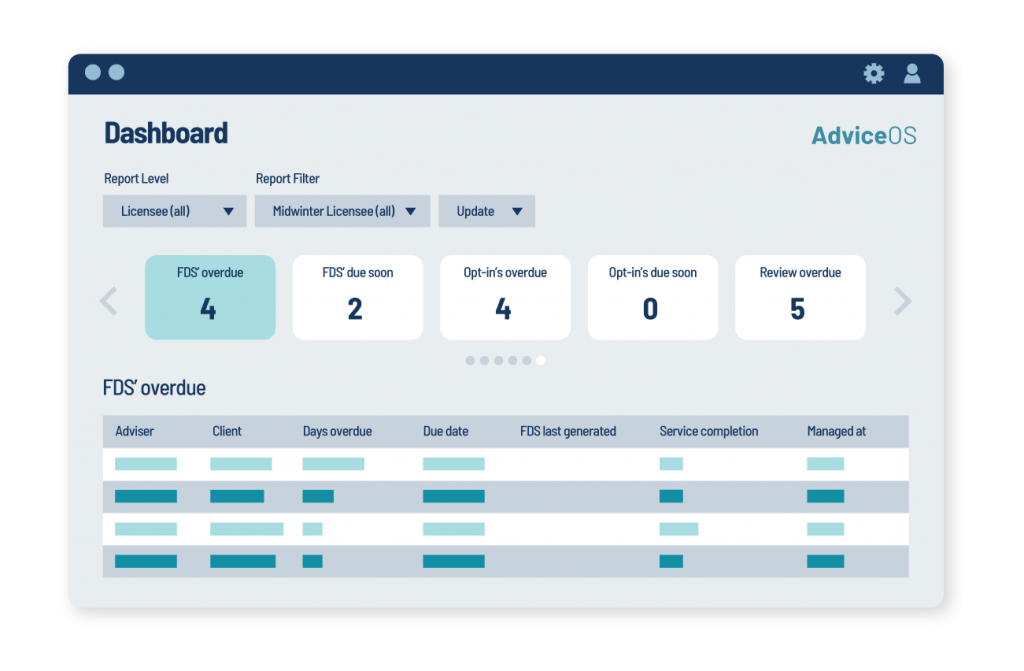

KEY RISK INDICATOR SOLUTION

Stay on top of your compliance and reporting obligations

Create alerts based on indicators of possible issues, monitor these on a daily or real-time basis and quickly address any potential breaches from your customised dashboard.

CLIENT PORTAL MODULE

Keep clients informed and engaged

The digital client portal provides a comprehensive fact find, objectives builder and document sharing to keep your clients informed and engaged in between meetings.

DATAFEEDS

Link directly to the information that matters

Connect to over 600 data feeds in Australia with InvestmentLink, an independent data repository that fully services all sectors of the financial market.

Case Studies

1st to market

With innovative advice solutions

2,000+

Trusted by 2,000+ financial advisers

550,000+

Serving the advice needs of 550,000+ Australians

Backed by global business Bravura Solutions

More resources

Subscribe to our newsletter

Stay updated on our latest market insights and company updates