Resources

Compare and review insurance products and generate an SOA in as little as 30 minutes.

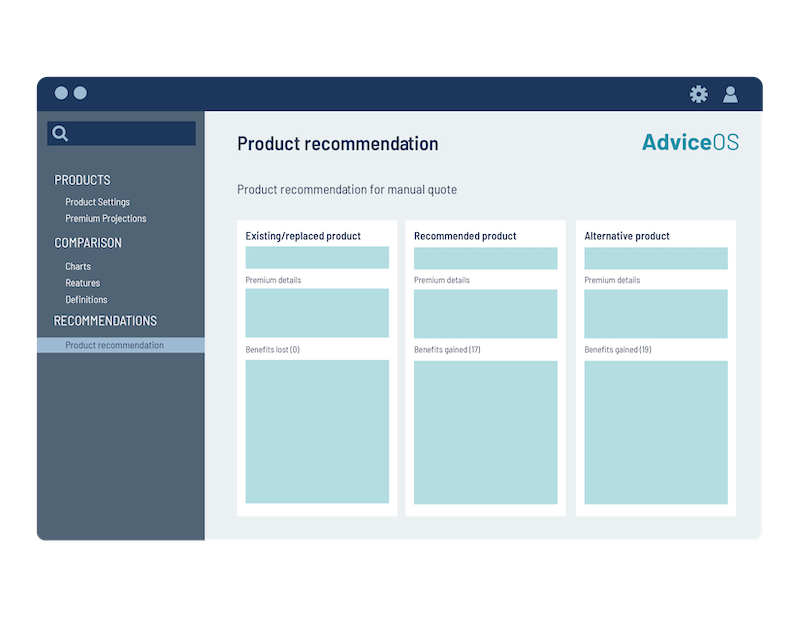

Quickly compare and recommend insurance products in AdviceOS using Omnium Insurance Comparisons.

Using the robust Omnium API, Insurance Comparisons will search more than 90 insurance providers to find options that match your criteria.

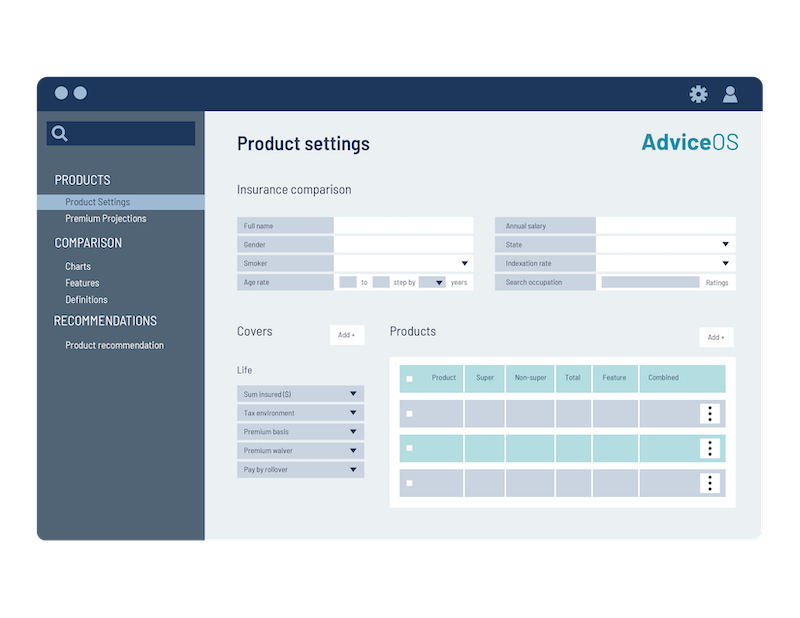

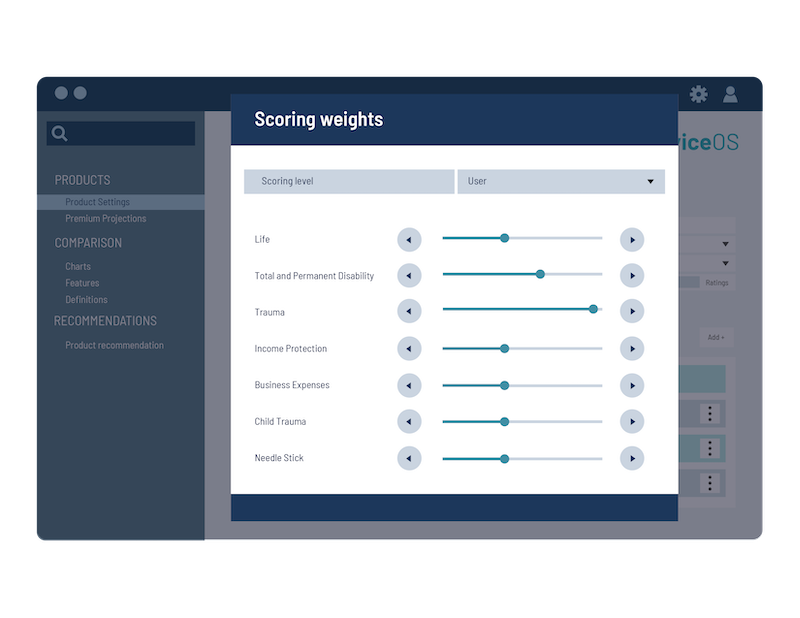

Fully integrated in AdviceOS, Insurance Comparisons uses the data from your client fact find and lets you select your desired cover and scoring to run a tailored insurance analysis for your client.

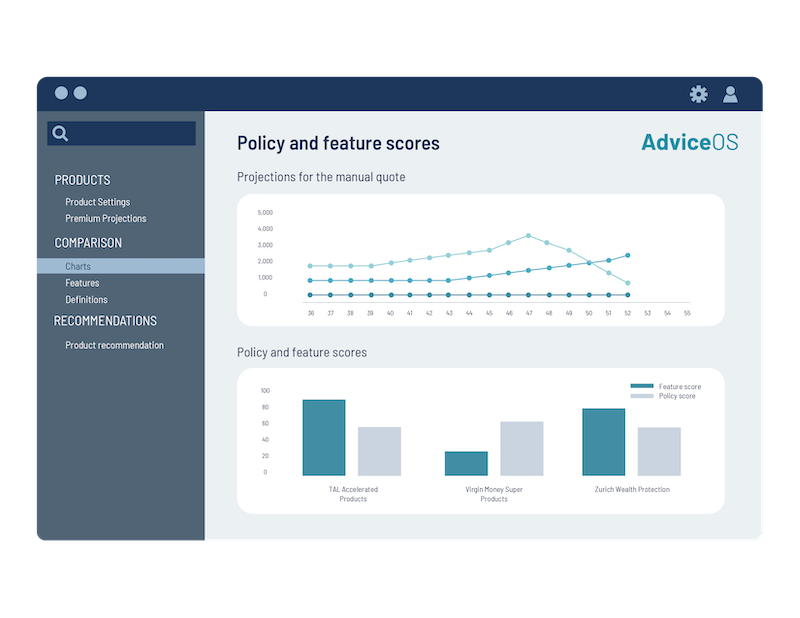

The visual insurance comparisons interface provides an easy way to run a like-for-like comparison across key criteria and provides a visual score for each policy against the stated client requirements. If you need more detailed information on a policy, the full PDS, a detailed feature analysis and policy definitions are available at your fingertips.

After you’ve selected the preferred insurance product, you can instantly validate that the quote is correct*. If the client decides to go-ahead, the Omnium insurance Comparison modules integrates directly with the insurance provider’s quote generation system so you can easily complete the purchase and avoid double entry*.

*Premium validation and application integration are not available for all providers.

Insurance Comparisons integrates with the Insurance Needs Analysis module so you can pull through any recommended and alternative products and easily generate an SoA.

How it Works

1

Research and compare insurance options.

2

Short-list options based on the client’s requirements.

3

Instantly validate that the quote is correct.

4

Generate a quick SoA including short listed options.

5

Purchase selected option with the form integration tool.

We have found the Omnium service to be a a user friendly and efficient program that interfaces smoothly with client details stored within Midwinter. Efficiency is gained via AdviceOS as there is no need to re-key client information and, of greater significancy is the seamless integration of ‘risk needs analysis’ from AdviceOS into the Omnium.

The qualitative and quantitative information is superior to other platforms and services that we have research and used to date. This includes the ability to compare group and industry risk offerings to retail offerings, thus providing clients with clear reasoning to retain or change their insurance policy.”

Gabriel Carey, Cadre Capital Partners

Subscribe to our newsletter

Stay updated on our latest market insights and company updates