Cashflow & Capital

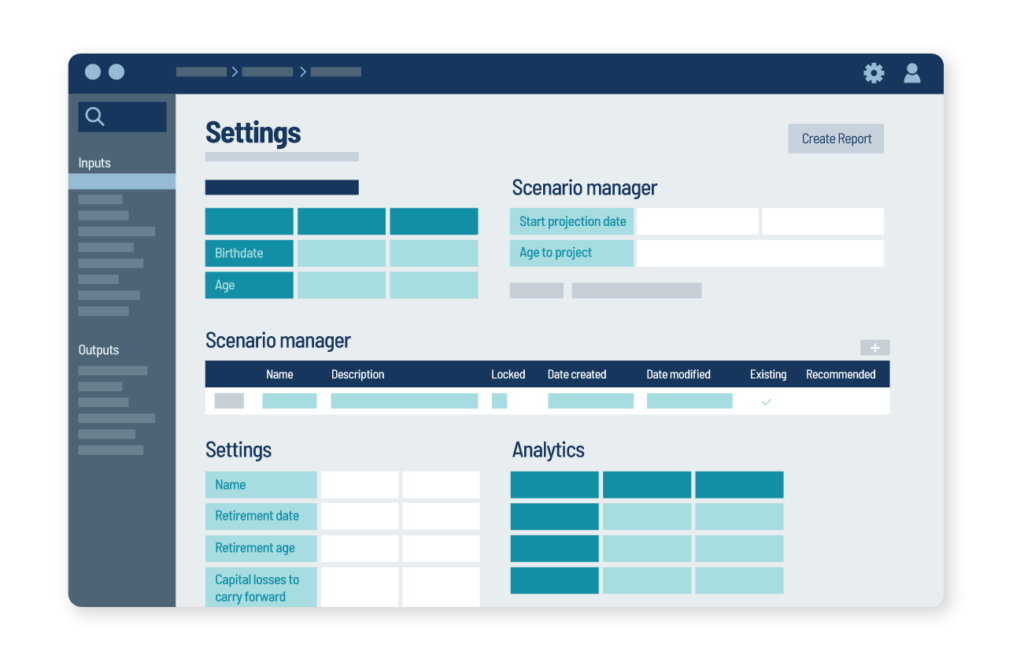

Cashflow & Capital is a comprehensive financial strategy modelling tool that allows advisers to create multiple scenarios, each with its own unique set of strategies, and view the impact of each strategy.

It also enables the adviser to provide advice based on cashflow, taxation and capital outcomes, and it allows advisers to do a like-for-like comparison of the modelled strategies.

Cashflow & Capital is available as part of the Strategy Module in AdviceOS.

Strategy modelling

Model both simple and complex strategies in one place.

Like-for-like comparisons

Model multiple strategies instantly and do a like-for-like comparison of the strategies.

This allows you to select the most appropriate strategy based on the client’s goals and objectives.

Fully integrated

Information and settings from the fact find flow directly into modelling, eliminating double entry.

Protect data integrity

Scenarios can be locked so that inputs cannot changed. This ensures data integrity for scenarios that are in use.

Features Section

- Model a variety of simple and comprehensive strategies.

- Optimise strategy by matching current net income.

- Allocation of surplus and deficits for a specified time frame, with overflow functionality.

- Customise returns at individual investment level.

- Stagger income and expenses for different life stages.

- Model short and long-term impact of capital expenses for a particular time period.

- Produce comparative cash flow and tax analysis of the existing and proposed positions.

- Accurately model Centrelink accessibility for annuity income.

- Automatically calculate Centrelink payments, including pre and post-retirement entitlements.

- Full control on the deeming of individual assets.

- Unrealised capital gains tax calculated annually.

- Realised capital gains applied to annual taxation.

- Produce SOA inserts or limited SOAs including current and proposed capital, tax and cash‐flow analysis.

- Recommended and/or existing scenarios can be automatically included in the SOA.